If you are like most people, you vastly prefer transparency regarding the fees you pay for goods and services. Murkiness, obscurity, and ambiguity are the hallmarks of unethical business practices.

For example, suppose you take your car to a mechanic because it is leaking oil. After repairs are complete, the invoice shows that you owe $1,195.75 for “parts and labor’” without any itemized list describing exactly what parts were replaced, the cost of each part, or the number of hours spent repairing the vehicle.

For example, suppose you take your car to a mechanic because it is leaking oil. After repairs are complete, the invoice shows that you owe $1,195.75 for “parts and labor’” without any itemized list describing exactly what parts were replaced, the cost of each part, or the number of hours spent repairing the vehicle.

Would you be satisfied with this kind of service? Probably not. Wouldn’t you ask this mechanic to justify these charges? Almost certainly. Why? Because you strongly prefer transparency regarding the fees that you pay.

In the credit card processing industry, some Merchant Service Providers conduct their business in a similar manner: They use pricing models that are riddled with obscurity, making it easier to charge hidden fees at their discretion.

This article will explain some little-known secrets of the electronic payments industry, showing how you can maximize your savings by having transparent monthly statements that are easy to understand.

Who are the players involved in every card processing transaction?

There are four primary players in every transaction:

- The major credit card associations (like Visa or MasterCard) who set the rates for the transaction process.

- The card-issuing bank who represents the consumer.

- The acquiring bank who funds the transaction.

- The Merchant Service Provider—that’s us, and we represent you. We are the agent of the acquiring bank.

How Card Processing Fees are Determined

One of the biggest reasons that merchant account pricing structures can seem complicated to the business owner is that there are numerous (and complex) ways to price accounts.

One of the biggest reasons that merchant account pricing structures can seem complicated to the business owner is that there are numerous (and complex) ways to price accounts.

When we talk about a “transaction,” we are referring to any interaction between the merchant and the processing bank.

There are a dizzying array of transaction types: indeed, over 400 in all. There are many factors that affect how a transaction is categorized and ultimately priced, factors such as the merchant’s industry, the type of card being used, whether the card is swiped or keyed, etc.

This system of categorization of transaction types is called “interchange,” and interchange fees are the true wholesale cost of credit card processing pricing models.

Understanding the Interchange Cost

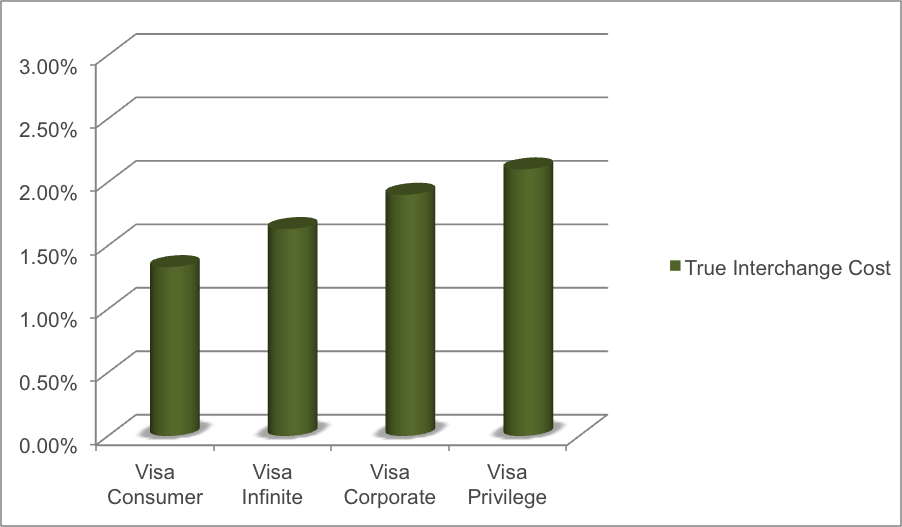

Interchange fees are set by Visa and MasterCard and paid to the consumer’s bank (the issuing bank). This is represented by the green in the chart below. These will vary depending on the type of credit card (e.g., consumer vs. premium) and how it is entered (e.g., card-present vs. manually keyed).

Processors and merchants of all sizes are legally bound by these interchange fees.

Twice a year, brands like Visa and MasterCard announce their schedules of fees and the various categories that credit card transactions can fall under.

This “wholesale transaction rate” is determined based on the criteria outlined in these fee schedules (pictured above).

What are the pricing models that are the most prevalent in the industry?

Two of the most common pricing models are tiered pricing and interchange plus pricing. To be sure, there are other models available, such as flat rate and subscription, but they are actually just variations of tiered pricing and interchange plus pricing. Thus, it’s essential to have a solid understanding of these two particular models.

Tiered Merchant Account Pricing

Tiered pricing usually consists of having a lower “qualified” rate for certain transactions and higher “mid” and “non-qualified” rates for others. Even though this is the most common pricing method in the US, it is not only characterized by obscurity—and a glaring lack of detail—it is also more expensive when compared to the interchange pricing model.

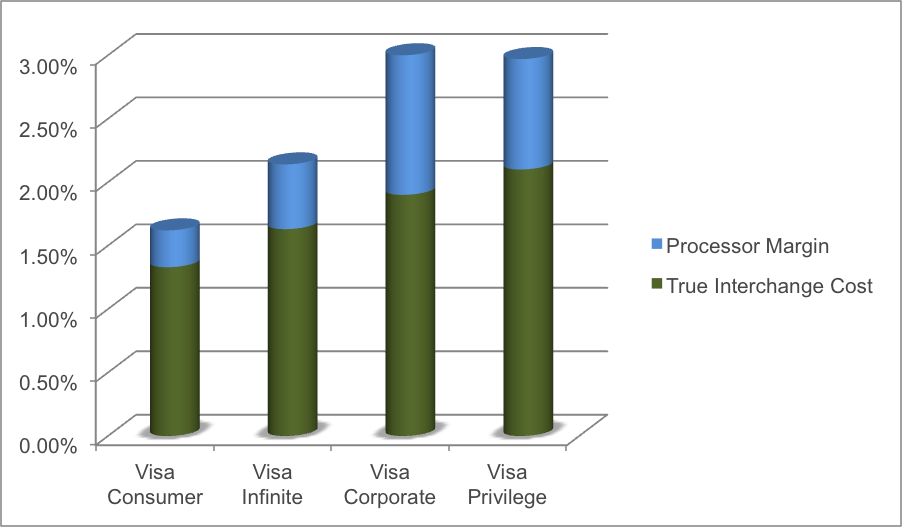

When we add tiered pricing to the chart we just used for interchange costs (again, the “wholesale cost”), here is what we get. Notice the processor margin represented by the blue ranges:

As mentioned, tiered merchant accounts work on a system of qualification to determine which rate tier a merchant’s transaction falls into. These tiers are sometimes referred to as “rate buckets.”

Here’s an example of what they typically look like:

- Qualified Discount Rate: 1.79%

- Mid-Qualified Discount Rate: 2.29%

- Non-Qualified Discount Rate: 3.49%

To be sure, there may be various other tiers in-between, as well as differences between credit and debit card charges. But the main point to understand is that the qualified discount rate represents a best-case-scenario: it represents the lowest fees a merchant will pay.

Downgrades for Tiered Pricing

However, the typical business rarely actually sees these tiered prices. Merchants are enticed with this low “qualified” rate but the majority of all of their transactions end up in the higher mid and non-qualified tiers. This is further complicated by downgrading. The reasons a transaction may downgrade include:

- The type of card that was used

- Whether it’s a personal or business card

- If it’s a cash back (or rewards) card

- If the card was keyed instead of swiped

- If there was no zip code verification

Unfortunately, business owners don’t have any control over what kinds of cards their customers may use to pay.

Thus, we have a situation that is doubly problematic: businesses are afflicted with murky monthly bills while being punished for circumstances they have no control over.

This is where we come in: Our primary goal is to provide a service that is fully transparent and offers businesses full control of this process.

Enter Interchange Plus: the pricing solution that works in your best interests.

Understanding Interchange Plus Pricing and Why It’s Beneficial To You

Traditionally, Interchange Plus pricing accounts were only available to businesses that process $100,000 monthly or more.

However, as the market for merchant accounts has become more competitive smaller businesses (including new businesses) can now take advantage of Interchange Plus pricing.

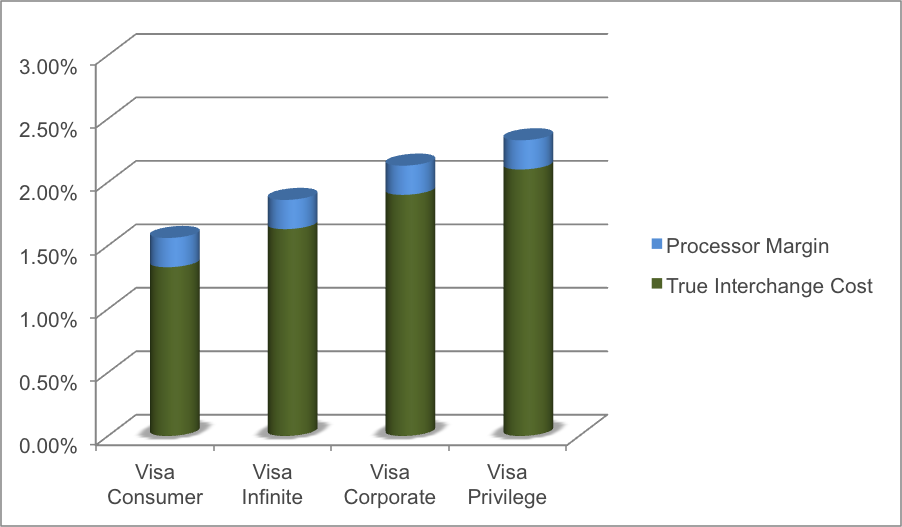

To understand some of the benefits of this model, look at the following chart. Notice the smaller Processor Margins when compared to the Tiered pricing model:

Under the Interchange Plus model, merchants pay an agreed margin plus the interchange (“wholesale”) cost plus a small fee per transaction (to cover the communication cost). For instance, if your business has a merchant account with a 0.30% rate and a 10 cent transaction fee, you would pay the wholesale interchange fee, plus 0.30%, plus 10 cents.

In essence, the processor passes the “wholesale” rate with their added value margin to you. This is similar to a bank buying a loan at prime. In such situation you will pay prime plus the margin on the loan. It is extremely transparent and easy to understand all of the charges involved.

Moreover, this margin is not an arbitrary fee. It covers the underwriting, risk management, sales, marketing, and customer service on the account. Similarly, the interchange covers the card issuer’s fees.

How is Interchange Plus different from other pricing models?

In the Interchange Plus pricing model, the interchange (the costs to issuing banks), assessments (the costs to the card brands  like Visa & MasterCard), and margin (the merchant service provider’s share) are separated.

like Visa & MasterCard), and margin (the merchant service provider’s share) are separated.

While it can make your statement look a bit more complex, it is remarkably transparent (especially compared to other models such as Flat Rate and Tiered Pricing).

Since every transaction includes those three factors of cost (interchange, assessments, and margin) the main difference in a statement is whether you see those charges itemized or not.

In a Flat Rate model, you will simply be charged one rate per transaction, such as 2.9% + 30 cents, for example.

With Tiered Pricing, you may see a long or a short list of complicated charges, but you will also undoubtedly find the obscure “non-qualified” charges that cost more for some transactions than others.

What makes the Interchange Plus model more transparent is the fact that each one of the charges is completely disclosed and much easier to analyze; and this makes it more difficult for processors to sneak in any extra fees.

The bottom line is that Interchange Plus statements offer more transparency than any other payment processing fee model.

Finally, consider the fact that most of their profits come from “downgraded” transactions that are not eligible for the best rate.

By having the power to control the process, banks will not be able to increase the prices of “non-qualified” transactions. The Merchant Service Provider will charge you based on their card rate and a negotiable amount.

So, what will you choose? Do you want a monthly bill whose murkiness can obscure a host of arbitrary charges, combined with a system that punishes you for circumstances beyond your control? Or would you prefer a monthly bill that is characterized by lower costs, full disclosure, and better control?

Choose transparency and better control on your rates: choose Interchange Plus. Save money on your transactions and maintain full control of your business.

All of us here at MSNI are committed to transparency, which we believe goes hand in hand with honesty and respect.

We believe that those values are a big part of the reason why our Clients have favored our company since 1997, with a five-star rating on Google Business Review.

That is also why we have an A+ rating with the Better Business Bureau, and why it is a top priority for MSNI to keep it that way.

Resources & References